The SaveYour Not-so-Secret of Success

by John Hansel Jr, EVP Marketing & Development, syDc • May 5, 2016

Understand platform power, and you’ll appreciate the future of SaveYourHealthCare.com. Thanks to The Harvard Business Review, and a nod to writers VanAlstyne, Parker, and Choudary for their article for helping us explain.[i]

Think Apple. How did they displace Nokia, Samsung, Motorola, Sony, and LG –collective controllers of 90% of world profits in 2007? How did the iPhone overrun these and capture 92% of profits, rendering former players with virtually 0% market share? Apple embraced a platform perspective - the definition of which is critical to understanding SaveYour’s view to success. HBR put it succinctly:

“Apple… overran incumbents by exploiting…platforms and leveraging…new rules of strategy. Platform businesses bring together producers and consumers in high-value exchanges. Their chief assets are information and interactions, which… are the source of the value they create and their competitive advantage. So, Apple conceived the iPhone…as more than a product or a conduit for services. It imagined them as a way to connect participants in two-sided markets—app developers on one side and app users on the other—generating value for both. As the number of participants on each side grew, value increased [in the] “network effects,” which is central to platform strategy. In 2015 the App Store offered 1.4 million apps, [generating] $25 billion for developers.”

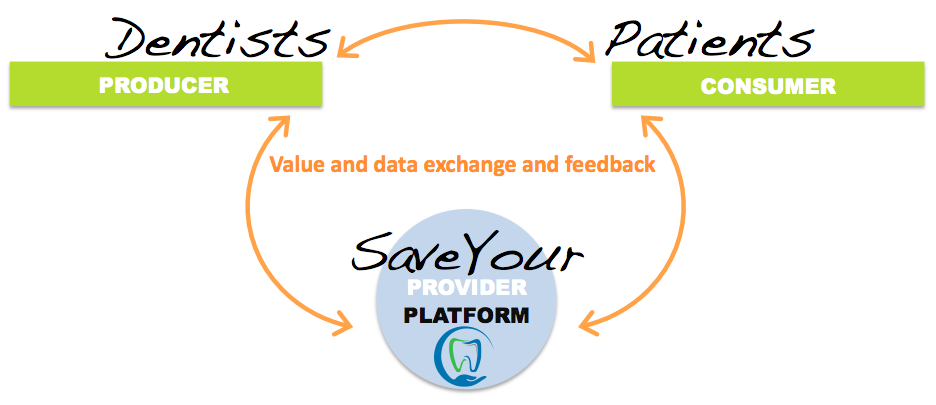

SaveYour is an information technology company. “IT makes building and scaling platforms vastly simpler and cheaper, allows nearly frictionless participation, strengthening network effects, and enhancing the ability to capture, analyze, and exchange huge amounts of data, increasing the platform’s value to all.” Like any effective platform, our model represents an eco system.

The platform perspective is understood in contrast to conventional “pipeline” methods of the past. “Pipeline businesses create value by controlling a linear series of activities—Inputs at one end of the chain (say, materials) undergo a series of steps that transform them into output that’s worth more: the finished product.” HBR points out, “Pipeline giants such as Walmart, Nike, and GE are all scrambling to incorporate platforms.” HBR adds the apt warning: Firms that fail to create platforms and don’t learn the new rules of strategy will be unable to compete for long,” and “You don’t need to look far to see examples of platform businesses, from Uber to Alibaba to Airbnb, whose spectacular growth abruptly upended their industries.”

[i] See… “Pipelines, Platforms, and the New Rules of Strategy”, by Marshall W. Van Alstyne, Geoffrey G. Parker, Sangeet Paul Choudary; in the Harvard Business Review, April 2016. All quotes above are from the same.