In recent years, the advent of technology and the rise of the internet have given birth to a new form of investment: crowdsourced investment. This innovative approach allows individuals from diverse backgrounds to pool their resources and invest collectively in a wide range of projects and ventures. While crowdsourced investment presents exciting opportunities for both investors and entrepreneurs, it is not without its challenges. In this blog post, we will delve into the world of crowdsourced investment, examining its potential benefits and the obstacles it faces.

Opportunities of Crowdsourced Investment

In a world where investment opportunities were once exclusive to the privileged few, crowdsourced investment has emerged as a powerful catalyst, opening doors to a diverse range of investment possibilities for individuals from all walks of life.

Access to Diverse Investment Opportunities

One of the primary advantages of crowdsourced investment is its ability to provide access to a vast array of investment opportunities. Traditionally, investing was limited to wealthy individuals or institutional investors with access to significant capital. However, crowdsourcing allows individuals with even small amounts of money to participate in investment ventures that were once out of reach. This democratization of investment opportunities can lead to increased economic growth and innovation.

Lower Entry Barriers

Crowdsourced investment platforms often have lower entry barriers compared to traditional investment channels. These platforms leverage technology to simplify the investment process, allowing investors to participate with minimal paperwork and lower minimum investment amounts. This accessibility attracts a broader range of participants, including those who are new to investing, thereby expanding the investor base.

Potential for High Returns

By investing in a diversified portfolio of projects or ventures, crowdsourced investors have the potential to achieve attractive returns on their investments. These returns can be especially significant in the case of successful start-ups or innovative projects that might have otherwise struggled to secure funding through traditional means. Crowdsourced investment has the power to fuel the growth of promising ideas that may have been overlooked by conventional investors.

Challenges of Crowdsourced Investment

While crowdsourced investment has disrupted traditional investment models, it faces a set of unique challenges that demand attention. From navigating the uncharted waters of regulation to taming the risks of uncertainty, this section explores the hurdles that accompany the dynamic world of crowdsourced investment.

Lack of Regulation

One of the primary challenges facing crowdsourced investment is the absence of comprehensive regulation. Unlike traditional investment markets that are closely regulated, crowdsourcing platforms operate in relatively uncharted territory. The lack of clear guidelines can leave investors vulnerable to fraud or other malicious activities. To address this challenge, regulators need to develop frameworks to protect investors while fostering innovation and market growth.

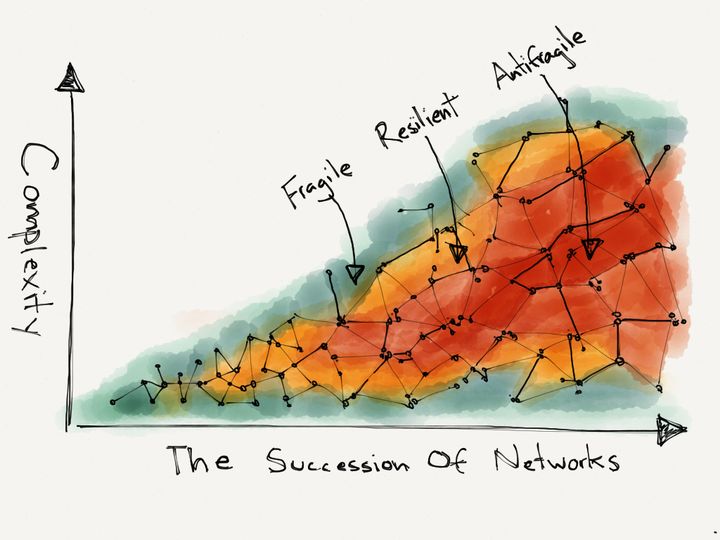

Risk and Uncertainty

Investing inherently carries risks, and crowdsourced investment is no exception. While the potential for high returns exists, there is also the possibility of losing one's entire investment. Crowdsourced investment often involves early-stage start-ups or unproven projects, which can be highly volatile and unpredictable. Investors must be aware of the risks involved and conduct thorough due diligence before committing their funds.

Limited Investor Control

Unlike traditional investment models where investors have a say in the decision-making process, crowdsourced investors often have limited control over the projects they invest in. The decision-making authority lies with the project creators or platform administrators, leaving investors with minimal influence.

Information Asymmetry

In crowdsourced investment, there can be a significant information asymmetry between the project creators and the investors. Entrepreneurs may present their projects in an overly optimistic light, highlighting the potential benefits while downplaying the risks. This imbalance of information can make it challenging for investors to make informed decisions. Transparency and disclosure requirements can help mitigate this challenge, enabling investors to assess projects more accurately.

Don't Miss Out

One thing is abundantly clear when it comes to crowdsourcing investment: the potential for success and impact is high. Countless success stories, such as the Oculus Rift, demonstrate the power of crowdsourcing to get innovative ideas and fuel entrepreneurial projects. From groundbreaking advancements in sustainable technologies to the flourishing of creative projects that captivate global audiences, crowdsourcing has proven to be a force that unlocks untapped potential.

The Oculus Rift serves as a shining example of how crowdsourced investment can propel groundbreaking technologies. Starting as a crowdfunding campaign on Kickstarter, the project not only surpassed its funding goal but also captured the imagination of VR enthusiasts worldwide. This early support propelled Oculus into the spotlight, leading to subsequent investments and ultimately an acquisition by Facebook, solidifying virtual reality's place in mainstream entertainment. Though not without it's controversy. This story shows the immense possibilities that lie within the realm of crowdsourced investment.

With continued collaboration among investors, entrepreneurs, and regulators, a future is possible where crowdsourcing becomes a driving force behind rapid innovation.

~

We look forward to reading about your success story. Not sure how to get started? Reach out to chat with a member of the HeroX team to see how you might leverage the power of the crowd for your next big project.