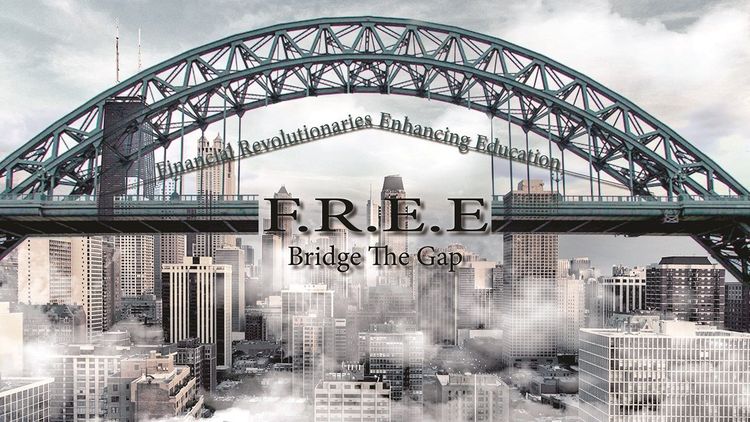

In their drive to enhance people's knowledge of finances and help them reduce their debt, FOUNDERS 55 NFP, Inc. - an Illinois-based non-profit corporation - launched the Financial Revolutionaries Enhancing Education (FREE) Challenge. Designed to address the underlying cause of the current debt crisis (which they identify as "financial illiteracy") this incentive-competition will award $5,000 to anyone who can create a video, speech, brochure, campaign, article, etc., that most effectively addresses the issue and calls people to action.

It is no secret that debt is one of the most pressing issues today, affecting individuals and society as a whole. Between families that are living from paycheck to paycheck to people over the age of 65 who cannot afford to retire, financial insecurity doesn't discriminate. Still it is perhaps in the realm of student debt that things become especially worrisome. With young people graduating from school already saddled with debt, the situation does not look like it is going to be getting better anytime soon.

According to the National Center for Education Statistics (NCES), roughly 20 million students enrolled in American colleges and universities this past fall. This represents an increase of about 4.9 million since the fall of 2000. And according to an analysis of government data, 70% of students graduating from post-secondary institutions these days do so with some form of debt, usually in the form of student loans.

Founders 55, an Illinois-based non-profit, is looking to enhance financial education to reduce people's debt. Credit: HeroX

Last, but certainly not least, the amount of debt the average student carries post-graduation is on the rise. As of 2015, the average student loan debt is over $35,000, which represents more than a three and a half-fold increase since 1993 (when it was under $10,000). Even when these figures are adjusted for inflation, they still work out to more than twice the amount students had to pay twenty years ago.

In short, in the coming years, more students are going to be graduating with more in the way of debt, thus adding to the overall problem. Clearly, there is a need and a desire for more financial education! And if people can be taught how to manage their finances at a younger age - for example, before they go to university or college - then chances are, fewer of them will be entering the job market already saddled with debt.

But how to go about doing that? That's where the FREE Challenge comes into play! In short, FOUNDERS 55 is seeking video testimonials, songs, brochures, or other forms of media that tell a story about financial illiteracy and why it is such an important issue. If you have a story about how debt is holding someone back, or how it plays a big role in your life, then pair that story with a call to action and send it in!

According to government statistics, those enrolling in post-secondary education in 2015 will be the most indebted graduating class in history. Credit: graduation.ubc.ca

Videos and printed material are to be no longer than 3 minutes or 3 pages in length, and will be evaluated based on their ability to show how this problem can be solved, and makes a clear call to action. The Challenge officially kicked off this past Monday, October 12th, and will remain open to submissions until Dec. 14th, 2015.

Judging will commence immediately after and will conclude on March 11th, 2015. The winner will be announced on March 14th. At the close of this Challenge, FOUNDERS 55 will start a second phase of the competition that is focused on solutions to a specific problem identified about financial literacy.

Do you have a story that highlights the problem of financial illiteracy and how it might be addressed? Then head on over to the Financial Revolutionaries Enhancing Education Challenge for a chance to win the prize!