The challenge to develop an innovative methodology begins as follows:

a. to ensure sustainability and financial inclusion to the small producers

b. to Reduce the gap between financial institutions and small producers that are unbanked or prefer to find liquidity through a risky and expensive channel.

c. Lack of adequate channels to expedite transactional operations in rural areas.

d. Lack of leadership and coordination for the processing of credit operations

e. The excessive costs for financial institutions to provide financing to small producers. It means visiting each farmer distributed in dispersed areas.

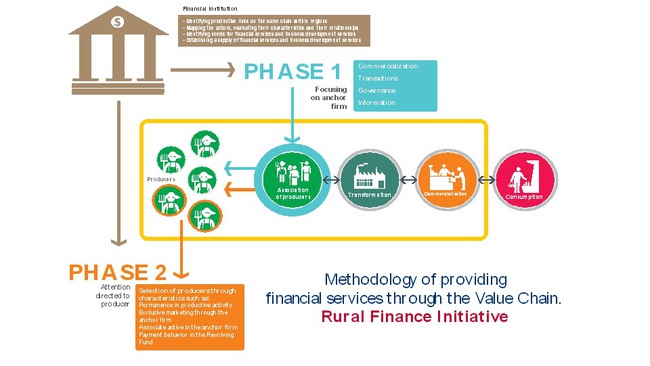

This methodology looks for an innovative analysis and evaluate local organizations with qualitative and quantitative issues that complement the analysis of credit risk. By doing so RFI identifies two phases within the process:

Phase 1: the objective is to establish the relationship between the organizations and FI by offering financial services according to their activities and strength. The main objective of the methodology is to reduce overhead costs, administration fees and loss in profitability during loan analysis where the anchor organization plays an important role in the process.

Anchor organizations are identified through variables such as formalization, governability and expertise in productivity in the sector. With that information, the financial intermediaries recognize what the necessities are. Consequently, the FI prepares the business model with an appropriate financial offer to anchor organizations in exchange for knowledge about small producers.

Phase 2: In accordance with the business model defined in phase 1, the financial institutions have learned from producers about commercial volumes, time of delivery, billed money, among others. As a result of the previous analysis, they can provide adjusted loans for each producer.

RFI is a program financed by USAID, which seeks financial inclusion through the TA and with the purpose of consolidating the supply of financial services in areas affected by the Colombian armed conflict, as a development strategy for the country. Once the RFI has been completed, the VCF Methodology will be adopted by the autonomous FIs that have achieved confidence in the model and that expected sustainable adoption.

Consequently, the relationship with public, private business and financial institutions are supporting the organizations in the Business Development programs plans adjusted for rural necessities, as a sustainability effort.

VCF Key Lessons Learned for short-term and long-term loans:

Loans should be short-term, before moving to a long-term loan, for the following reasons:

• Know current status of specific value chain actors to determine if they require targeted TA to strengthen capacity.

• Improve income levels in the short term.

• Build trust between FIs and the lead organization or channel.

Provide long-term financing and investment options while:

• Maintaining open information channels.

• Providing credit options to other actors involved within the value chain to share risk.

• Reviewing investment plan and process investment capital.

In order to properly transfer the suggested model with interested partners, the Initiative is providing training sessions aimed at different departments within each FI, in order to define, promote coordination, and gain buy-in, which sets the stage for testing the new VCF model throughout 2018.

Value chain finance can be used to share risk and return among different actors in the value chain, such as a large buyer and small producer. Since 2017, the Initiative has visited a total of 120 different producer associations to determine the viability of their participating in VCF pilots. Out of this number, RFI determined that 76 of them are not viable due to lack of capacity or lack of markets. The remaining 44 viable associations were paired with the partner FI that best fits their financial needs and other selection criteria: FI presence in the pilot area, and client history between the association and the potential FI. Since 2017, the Initiative started implementing initial VCF activities with 13 associations, where all of them have been awarded VCF loans by FIs thanks to RFI technical assistance, and three additional associations have their loans approved and are pending disbursement. Additionally, three associations (COOAPOMIEL, Café Macizo, and COMCACAOT) were notified that their second loan had also been approved. Similarly, some of these associations (Café Macizo, COMCACAOT, and ASOTBILBAO) have also benefited by the fact that FIs are already working directly with their members by offering them individual loans.

In Value Chain Finance, RFI presented an updated VCF model to nine partners (Bancamia, Banco Davivienda, Banco de Bogotá, Bancompartir, Congente, Crezcamos, Interactuar, Microempresas de Colombia, and Opportunity), and two of them, Interactuar and Opportunity, incorporated this innovative mechanism into their services. This provides the platform for FIs to invest in expanding VCF activities, applying lessons learned from 2017 VCF pilots. Furthermore, RFI identified a promising new financial intermediary partner in the Corporación Nariño Empresa y Futuro – Contactar, which expressed interest in developing joint VCF activities.

Financial Intermediaries such as (Bancamia, Banco Davivienda, Banco de Bogotá, Bancompartir, Congente, Crezcamos, Interactuar, Microempresas de Colombia,Opportunity, and Contactar) and Local associations like (COOAPOMIEL, Café Macizo, COMCACAOT, and SOTBILBAO). Please see the other partners in the document attached.