Collaborative Consumption. Reputation Marketing. Trust Metrics. The Sharing Economy. Chances are, you've heard these terms being thrown around lately in the news, scholarly articles, or online discussion forums. And much like the conceptsof "global village" and the "internet of things", they are concepts that are not understood by many, but which are nevertheless central to understanding the modern age.

So what exactly is meant by the term "Sharing Economy?"

Basically, the sharing economy refers to a socio-economic system that is built around the sharing of human and physical resources. It includes the shared creation, production, distribution, trade and consumption of goods and services by different people and organisations. The term began to appear in the mid-2000s, as new business structures emerged inspired by enabling social technologies and an increasing sense of urgency around global population growth and resource depletion.

This business model is behind the creation of eBay, Craigslist, and Krrb - major online marketplaces where people are free to search for desired items, advertise products and services, and negotiate prices in a way that is open and not dependent on a centralized authority.

Thie concept is also present in emerging sectors such as peer-to-peer business services (such as Alibaba), social lending, peer-to-peer accomodations (Airbnb), peer-to-peer travel experiences, peer-to-peer task assignments travel advising, car sharing (Uber), or commute-bus sharing.

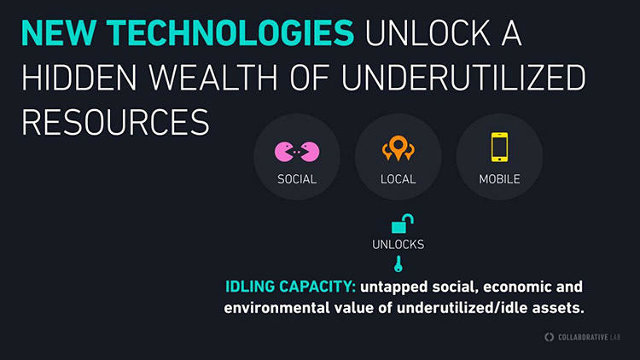

These systems take a variety of forms, but are commonly developed around the idea of using information technology and peer communities to empower individuals, corporations, non-profit organizations and governments to distribute, share and reuse excess capacity in goods and services.

Central to this sort of system is the revolution made possible by digital technology and the internet revolution. As more and more of our activities are quantified online, our behavior is becoming commodified and our actions becoming a new form of social currency. It is believed by many that this trend will continue, moving us away from centralized, depersonalized systems of ownership and distribution towards an economy built on social connections, reputation indexes, and even trust

This is what is commonly referred to as "Reputation Marketing", which is a intrinsic part of the Sharing Economy.

At the heart of this trend are such things as social media, online shopping, and online reviews. With everything from used goods, furniture, clothing and cars to accommodations up for review, people are turning to web-based recommendations like never before. In fact, a 2012 study done by Neilsen Media Research suggested that 70% of all consumers trust online reviews, which are now second only to personal recommendations.

For many people, this represents a positive development, since it means we are moving away from the depersonalized world of institutional production toward a new economy built on social connections and rewards.

One such individual is Marina Gorbis, the head of the Institute for the Future (IFTF), a California-based think-tank concerned with long-term planning and future studies. In her book The Nature Of The Future: Dispatches From The Socialstructed World, she explores the development of what she calls "socialstructuring".

In Gorbis’ view, socialstructing will present opportunities to create new kinds of social organizations – systems for producing not merely goods but also meaning, purpose, and greater good.

A key aspect in the rise of socialstructuring, according to Gorbis, is the development of social currencies. These include electronic banking (a la Paypal), but have expanded in recent years to include completely decentralized cryptocurrencies like Bitcoin, Namecoin, Lightcoin, and many others. These latter forms of digital currency operate much differently than regular currencies, in that they rely on public demand and collective support rather than market principles, centralized governments or banks.

Beyond social currencies is the development of social organizations that are dedicated to building a reputation or trust metric, which in turn can be redeemed for real and virtual products and services. The Whuffie Bank is a good example of this, an organization that takes its name from the reputation-based currency used in the novel Down and Out in the Magic Kingdom, by Cory Doctorow.

The Whuffie Bank, which is headqaurtered in Buenos Aires, issues whuffies based on a reputation algorithm that blends information from different social networks to measure the online reputation of its contributors. As they say on their website:

“As we develop and refine the algorithm that tracks public user activity over the net, the whuffie will become an accurate reflection of your web reputation. And as the Internet and social networks become a large part of people’s lives, your web influence will become an increasingly accurate reflection of you.”

Then there is the MetaCurrency Project, a non-profit organization dedicated to "building the core infrastructure for open sourcing money & currencies." Basically, this amount to inventing the tools needed for an open-source economy and social exchanges, and includes everything from developing the necessary technology to rethinking the very concept of currency and how it is valued.

They reason that currency is a form of technology used to map "flows" (i.e. human behavior) in a way that is similar to writing - another form of ancient technology. Human beings, as social creatures, are in the habit of generating wealth through their shared experiences, work, and interaction, all of which is measured and valued.

Building on this, the Project seeks to use the emerging global community powered by the internet to create a new kind of economy, one which is build on "instrinsic motivation" rather than extrinsic. In other words, they hope to foster an economy which is driven by personal ingenuity and desire, rather than a system of rewards or punishments.

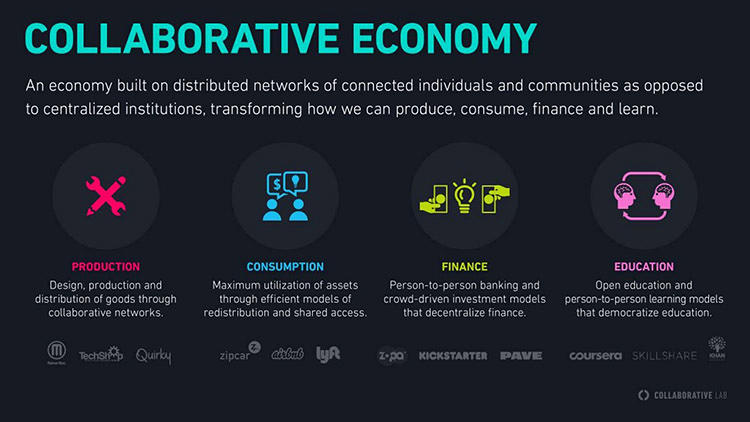

Another proponent of this change is Rachel Botsman – consultant, author, former director at the William J. Clinton Foundation, and founder of the Collaborative Lab. In her ongoing series of lectures, consultations, and her book What’s Mine Is Yours: The Rise of Collaborative Consumption, she addresses the transformative power collaboration will have, giving rise to such things as “reputation capital” and the “reputation economy”.

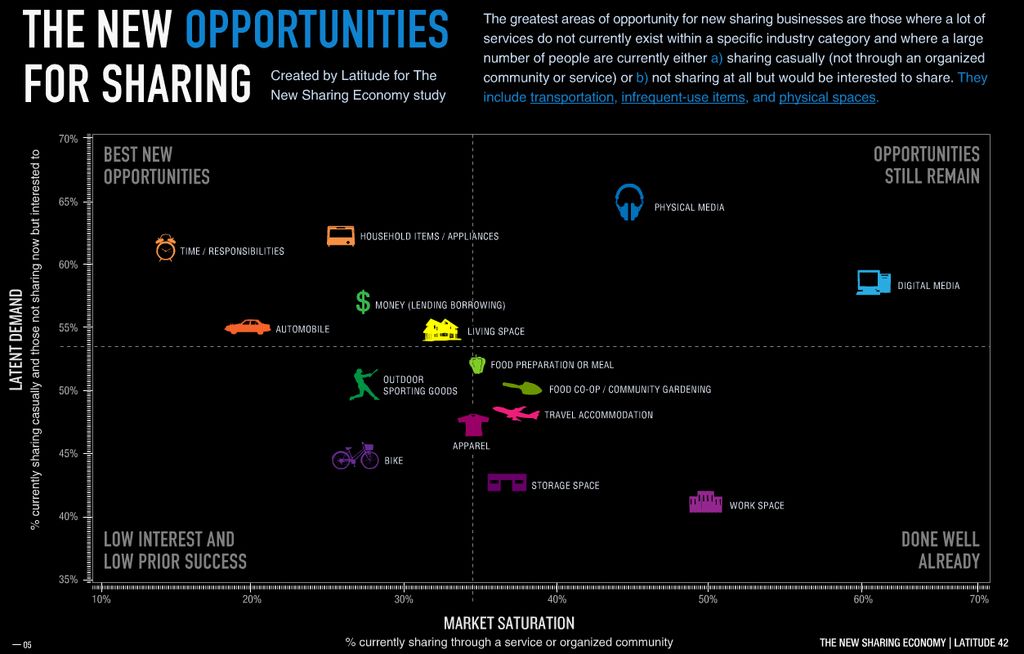

According to Bostman, in recent years there has been an explosion in collaborative consumption. This has embraced everything from the web-powered sharing of cars, to apartments, and even skills. In short, people are realizing the power of technology to enable the sharing and exchange of assets, skills and spaces in ways and on a scale that was never before possible.

The irony in this, as she states, is that this emerging trend is actually taking us back to old market principles which were thought to have been abandoned with modern industrial economy. In short, this decentralizing, distributed trend has more in common with bartering and shopping at the local agora.

According to Botsman, these behaviors – which predate all the rationalization and vertical/horizontal integration that’s been taking place the industrial revolution – are hardwired into us, but are being updated to take place in the “Facebook age”.

Through connections enabled by internet access and a worldwide network of optic cables, we are able to circumvent the impersonal economic structures of the 20th century and build something that is more akin to our needs.

Or, as Botsman summarized it in her article with Wired UK:

Imagine a world where banks take into account your online reputation alongside traditional credit ratings to determine your loan; where headhunters hire you based on the expertise you’ve demonstrated on online forums such as Quora… where traditional business cards are replaced by profiles of your digital trustworthiness, updated in real-time. Where reputation data becomes the window into how we behave, what motivates us, how our peers view us and ultimately whether we can or can’t be trusted…

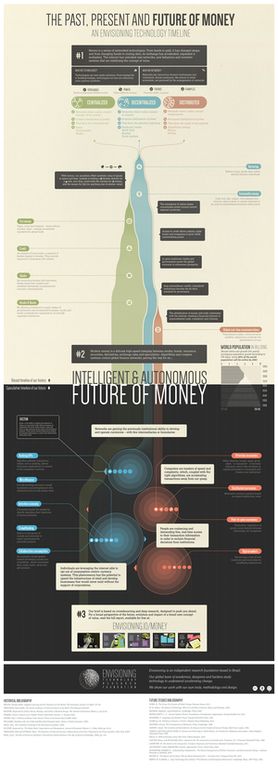

These sentiments echo what the independent research organization Envisioning Technology predicted with their recent infographic, The Future of Money. By examining the trends that affect the buying, selling and investment patterns of people over time, the graphic discerns three trends that are interwoven and have moved between centralized, decentralized, and distributed monetary systems.

These sentiments echo what the independent research organization Envisioning Technology predicted with their recent infographic, The Future of Money. By examining the trends that affect the buying, selling and investment patterns of people over time, the graphic discerns three trends that are interwoven and have moved between centralized, decentralized, and distributed monetary systems.

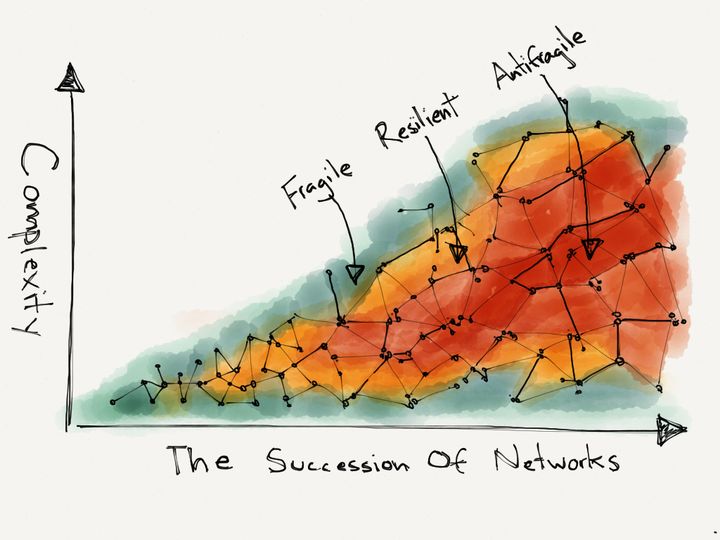

In this scenario, centralized tendencies refer to networks where the nodes are connected through dense centers (aka. urban environments), which rely on hierarchically structures institutions (i.e. banks) and require legal tender (physical money). This sort of system relies on an ordered distribution of power, one that generally favor the connected few, and which emerged with the advent of modern industrial civilization.

Decentralized tendencies are those which are based on networks where nodes connect in clusters, that have irregular distributions of power, and favor the selected individual. As the graph shows, these types of networks predate centralized networks, taking the form of bartering and commodities in earliest times, but which have emerged yet again in the modern era and are predicted to continue to grow.

Examples of current and future trends here include crowdsourcing, crowdfunding, banking APIs (Application Programming Interfaces), microfinance, and collaborative consumptions – where access is developed so that consumers can lend, swap, barter, share, and gift products. Whereas this model predates centralized tendencies, it is once again emerging with decentralizing potential of digital technology and open-source databases.

In the third and final method, one which is emerging, is the distributed network of money. These are networks where nodes connect independently, where power is distributed horizontally, and which favor the entire network. This trend began as a result of global real-time communications (i.e. the internet, satellite communications, etc.), and which are expected to expand.

The essence of this final stage is a network economy that is controlled by individuals, not financial institutions or corporations. In addition, currencies are based shared belief in their value, transactions occur between individuals, and physical currencies are replaced by digital ones.

To some, this all may sound a bit utopian or high-minded. But the exciting thing is the fact that what is being predicted is based on changes already underway in our global economy. Much like the invention of the telegraph, the radio, the television, and of money and writing themselves, the digital age is making developments and connections happen that would have been impossible for previous generations.

Refinements certainly need to be made in order to ensure that the potential for abuse is minimized. But as with all things, the key lies in understanding. Only through informing ourselves about these particular trends and developments can we truly expect to benefit from them and avoiding the possible pitfalls.

And be sure to enjoy the following video of Marina Gorbis explaining the concept of social structuring and the future:

And here is Rachel Botsman explaining Collaborative Consumption at TEDx Sydney:

Sources:

- www.fastcoexist.com/1681790/your-reputation-will-be-the-currency-of-the-future

- hbr.org/2014/11/what-airbnb-uber-and-alibaba-have-in-common

- www.wired.co.uk/magazine/archive/2012/09/features/welcome-to-the-new-reputation-economy?page=all

- www.envisioning.io/money/

- www.iftf.org/futureworkskills/

- thewhuffiebank.org/

- metacurrency.org/

- www.collaborativeconsumption.com/lab/

- www.economist.com/news/leaders/21573104-internet-everything-hire-rise-sharing-economy

- www.theatlantic.com/business/archive/2014/11/how-the-sharing-economy-makes-working-easier/382747/

- www.wired.co.uk/magazine/archive/2012/09/features/welcome-to-the-new-reputation-economy?page=all

Image Credits:

- Top Image: Forbes

- Collaborative Consumpion: macrobusiness

- Collaborative Economy: Collaborative Lab

- Bitcoin Image: Forbes/Cyberbeast

- Rachel Botsman: TEDx/Creative Commons

- "New Technologies": Collaborative Consumption

- Future of Money: Envisioning.io